Notre Affaire à Tous has released the fifth edition of its Multinationals’ Climate Vigilance Benchmark, assessing the climate vigilance measures of 26 major French companies operating in high-emission sectors (1). The findings are alarming: the targets set by these corporations would only lead to a 12% reduction in emissions by 2030, a far cry from the 50% reduction required by the Paris Agreement. In this context, the association underscores the critical importance of maintaining the obligations set out in the CSRD and CSDDD (2) as adopted under the previous European Parliament mandate and calls on MEPs and Member States to massively reject the disastrous Omnibus law proposals, introduced by the European Commission on 26 February, which represent a major rollback of environmental and social standards.

While the Omnibus bill, unveiled by the European Commission on 26 February, threatens key regulations designed to hold multinationals accountable for human rights and environmental harm—including the CSRD, CSDDD, and the EU taxonomy , the 2025 edition of the Multinationals’ Climate Vigilance Benchmark makes one thing clear: self-regulation is a failure, and without binding regulations and effective enforcement mechanisms, companies will not transition towards sustainability at the required pace.

In France, the Duty of Vigilance Act legally requires companies to identify, prevent and mitigate risks related to human rights violations and environmental damage. However, due to the absence of a dedicated supervisory authority and the lack of political will from successive Macron governments, the law remains largely under-enforced—especially regarding climate-related obligations, while compliance with it relies entirely on the mobilisation of NGOs and civil society.

However, the emissions from scopes 1, 2 and 3 of the 26 French multinationals analyzed in the report amount to 2,577 MtCO2eq, which means that they alone have the power to influence 4.51% of global GHG emissions (3). These figures highlight the relevance and urgent need for robust climate regulations targeting multinational corporations.

Yet, despite this significant responsibility, the fifth edition of the Benchmark reveals that companies still do not feel compelled to do their bit to limit global warming to 1.5°C. The climate targets set by the companies analysed would result in just a 12% reduction in emissions by 2030. Achieving these targets is neither in line with the 50% (4) cut required, nor backed at this stage by sufficient concrete measures.

And for good reason: while almost all companies now include climate issues in their vigilance plans – with the exception of Veolia and Casino – many still seek to limit their individual liability, by using evasive arguments, including:

- Referring to collective responsibility and the global nature of climate change. This is the case with TotalEnergies, which describes climate change as “a global risk for the planet resulting from various human actions, including energy consumption.” However, the company fails to acknowledge its ability to halt the development of new oil and gas projects and making an urgent transition to low-carbon energy, notably by transforming its supply, influencing demand, and reducing its own indirect emissions.

- Refusing to adopt the vigilance measures that are required for scope 3 emissions, despite their dominant role in most corporate carbon footprints. Renault exemplifies this strategy: its vigilance plan fails to acknowledge that emissions linked to the use of its vehicles significantly contribute to global warming. Consequently, the company is still not implementing decarbonization measures aligned with the 1.5°C goal of the Paris Agreement.

- Claiming that public subsidies are a prerequisite for transition, even when making record profits as a recent report has shown (5). This is the case with ArcelorMittal, whose decarbonisation strategy remains technically uncertain and heavily dependent on public subsidies, despite generating substantial profits each year. This claim appears disingenuous, particularly given that, even with public support, the company announced in November 2024 the suspension of its decarbonization project at its Dunkirk site – a site responsible for 3% of France’s total CO₂ emissions (6).

- Advocating for stronger state regulation while opposing it in practice. Some corporations insist in their vigilance plans that regulatory intervention is necessary, yet they have the financial means to act immediately… and systematically oppose regulations such as the CSRD and CSDDD whenever possible.

These examples highlight the urgent need to impose clear, binding rules on companies to ensure they genuinely integrate climate issues into their strategies. Without immediate and decisive change of direction, corporations will continue to worsen the climate crisis rather than help solve it.

Invitation to the presentation webinar: register link.

Press contacts

Justine Ripoll, Responsable des campagnes : justine.ripoll@notreaffaireatous.org

Anne Stevignon, Juriste Multinationales : anne.stevignon@notreaffaireatous.org

Brice Laniyan, Juriste Multinationales : brice.laniyan@notreaffaireatous.org

Notes

(1) EDF, ENGIE, TotalEnergies, AXA, BNP Paribas, Crédit Agricole, Natixis, Société Générale, Air Liquide, ArcelorMittal, Bolloré, Schneider Electric, Veolia, Aéroports de Paris, Airbus, Air France – KLM, Michelin, Renault, Stellantis-PSA, Bouygues, Eiffage, Vinci, Auchan, Carrefour, Casino, Danone.

(2) Corporate Sustainability Reporting Directive (CSRD) and Corporate Sustainability Due Diligence Directive (CSDDD)

(3) UNEP, Emissions Gap Report 2024, 15th ed. With a margin of uncertainty due to the lack of transparency on the part of certain companies, particularly financial players – see graph on page 14.

(4) This is the minimum value to be reached to be in line with 1.5°C according to the UN HLEG on corporate climate commitments

(5) ‘Shareholders over than solutions – How large companies prioritise remuneration over the energy transition’, SOMO and Friends of the Earth Europe, 2025: the financial cost of complying with the CSDD – as estimated by the European Commission – would represent only 0.13% of average payments to shareholders in 2023.

Ressources

Useful resources included in the Climate Vigilance Benchmark:

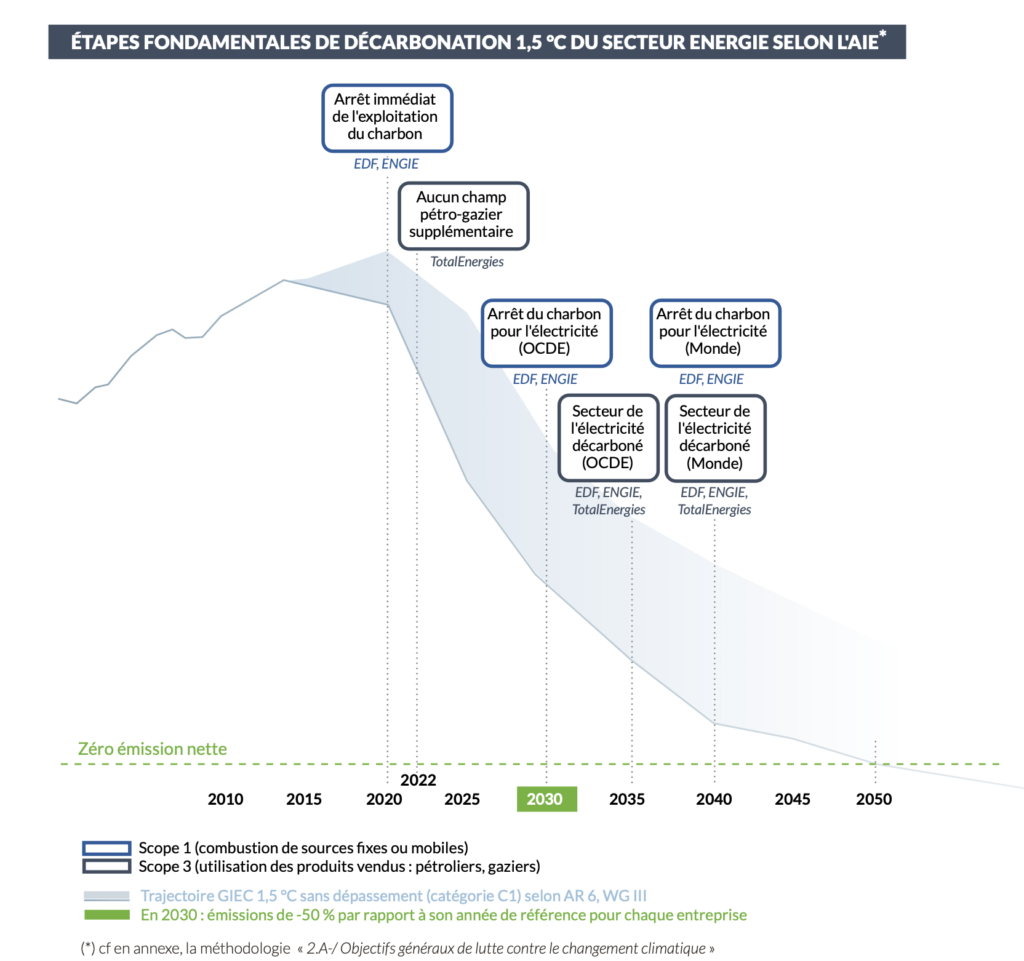

- Graphs illustrating the key stages of transition for each sector. Example: The energy sector transition roadmap:

- Tools to help you understand our methodology.

- A tool for understanding scope 1, 2 and 3.

- Detailed analyses by company.

- A podium of the worst performers in terms of climate vigilance, as well as the overall ranking of the 26 companies analysed.